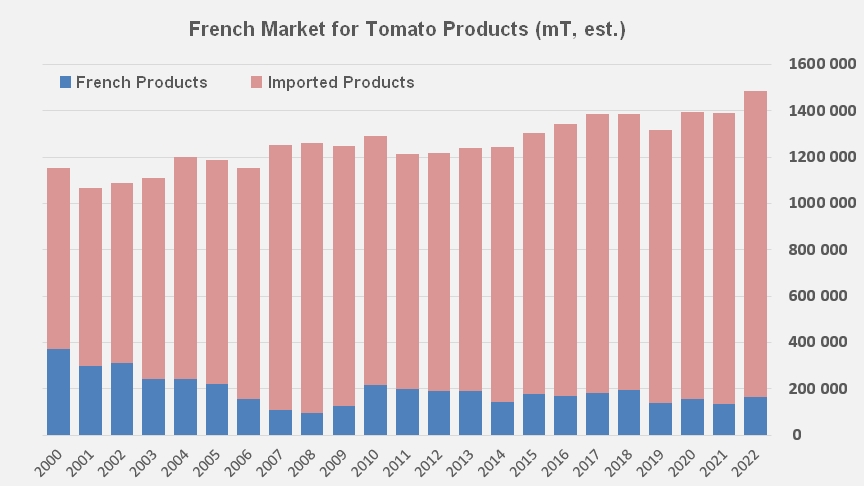

With production accounting for less than half a percent of the world total, at about 150,000 metric tonnes of tomatoes processed annually, and domestic consumption of tomato products estimated at 1.5 million tonnes of fresh tomato equivalent, the French market – the world's third-largest in terms of net value – is extremely dependent on neighboring operators.

The value of the French market

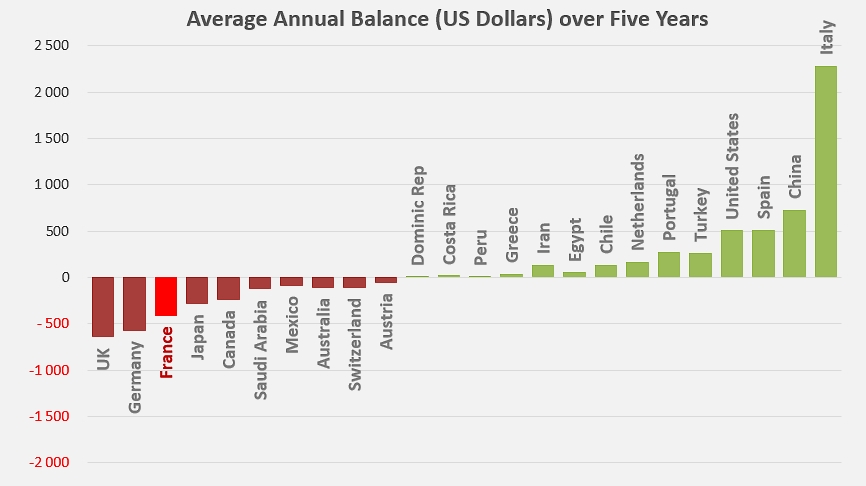

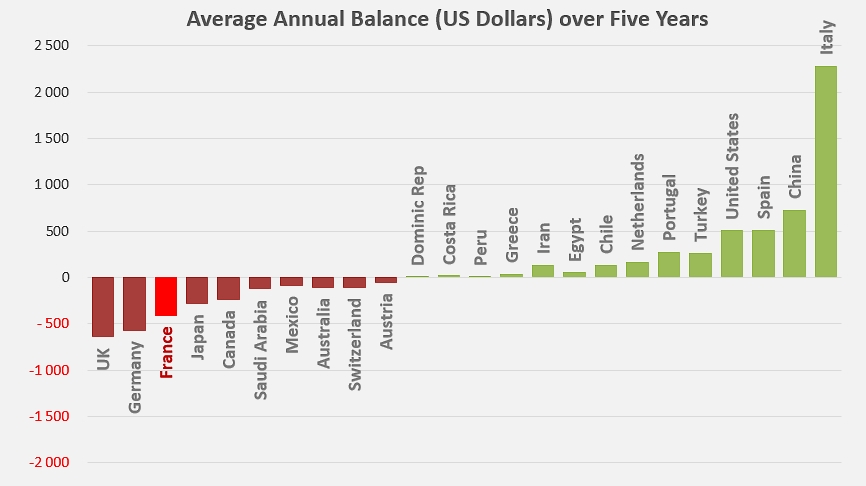

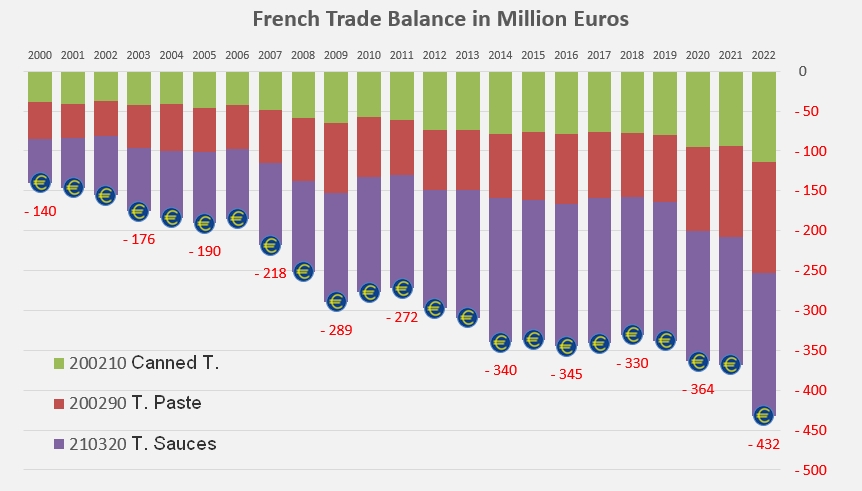

Over the average of the last five years (2018-2022), France's trade balance in tomato products has ranked 3rd worldwide in terms of value.

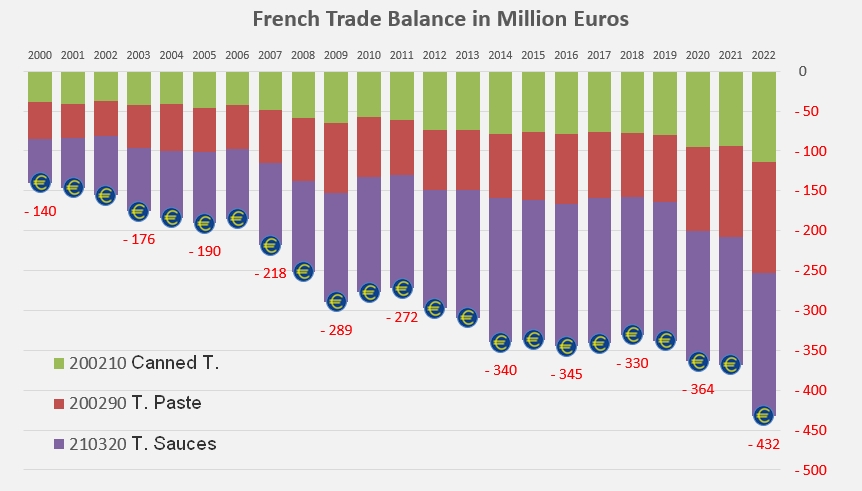

Over this period, average net expenditure amounted to EUR 366 million (around USD 415 million, much higher than Japan (USD 286 million) or Canada (USD 247 million), but much lower than Germany (USD 577 million) and the UK (USD 648 million)). Last year's financial results were marked by a sharp deterioration in the trade balance, with a deficit 25% higher than the relatively stable average of the previous eight years). This widening deficit is the consequence of the increase in quantities imported, particularly in the paste and canned tomatoes categories, but also and above all of the rise in product prices.

The French market's trade balance is a far cry from that of the Chinese industry (USD 727 million) or those of neighboring Spain (USD +515 million) or Italy (USD 2.28 billion).

The size of the French import market

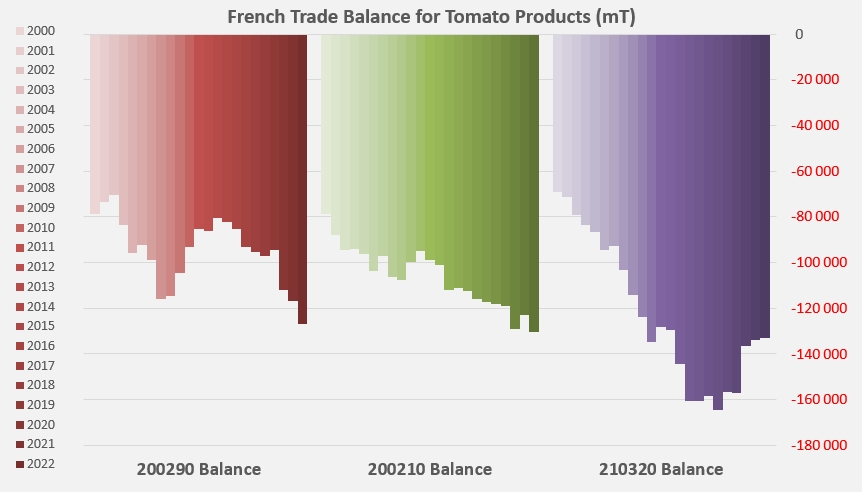

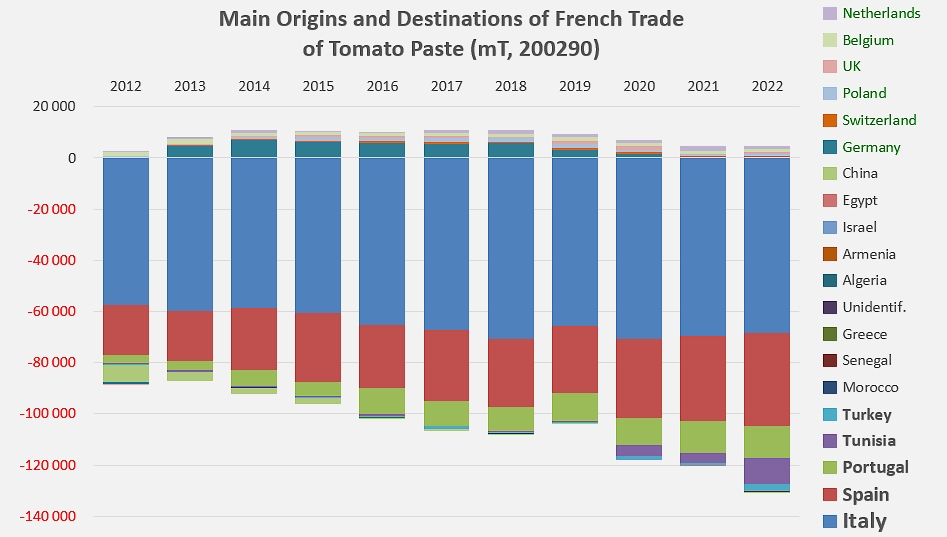

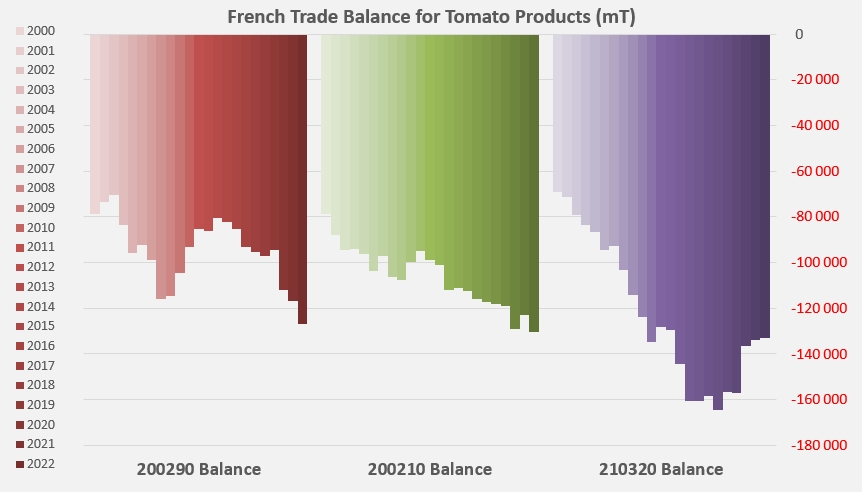

In terms of average annual volumes over the last five years, France ranked 4th among world importers of tomato pastes, behind Japan, the United Kingdom and Germany, with a trade balance deficit of 127,000 tonnes (all product types combined), amounting to a significant decrease compared to the previous year (8%) and to the average for the previous three years (18%).

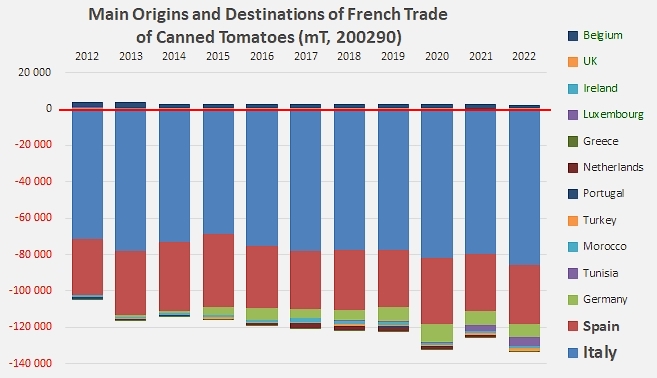

For the canned tomatoes sector, over the same reference periods, France's trade balance ranked 3rd worldwide behind the UK and Germany, with a deficit of 130,000 tonnes, higher than previous years (6% and 5%).

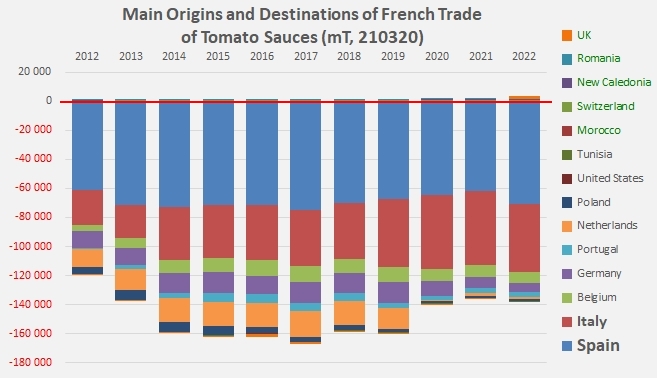

Finally, despite a marked slowdown in foreign purchases, the French sauces and ketchup market is the most dependent category in terms of supplies: France is the world's second-largest market behind the UK, with a trade deficit of 133,000 tonnes in 2022, 7% better than the average of the last three years.

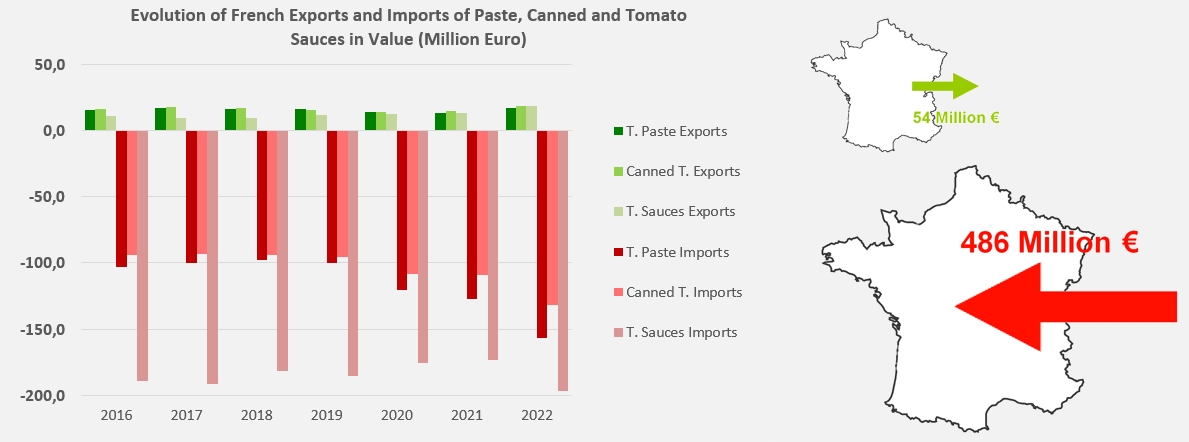

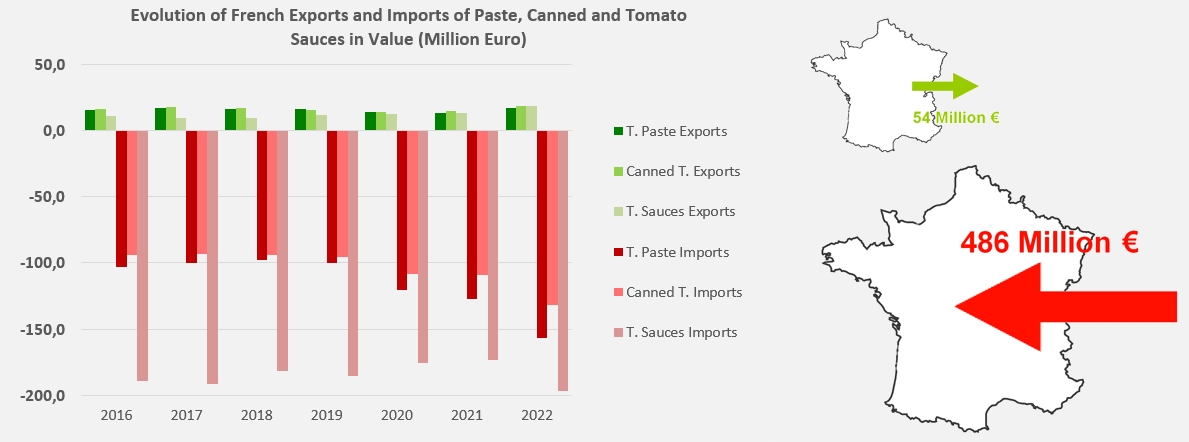

This high level of dependence is reflected in a significant imbalance between revenues from exports (around EUR 54 million) and expenditure to supply the French market (EUR 486 million), resulting in an annual bill that reached EUR 432 million in 2022, up EUR 75 million (+21%) on the average expenditure for the 2019-2021 period.

In short, French foreign sales bring in precisely nine times less than the cost of supplies, and the economic blow caused by the conflict in Ukraine, by the health crisis, by freight disruptions, by inflationary pressures, etc., has erased the minimal savings made on occasion on spending for imported sauces or thanks to the slowdown (in terms of quantities) of canned tomato imports. The 2022 bill was higher by one-quarter (EUR 432 million) than the relatively stable average of the previous eight years (EUR 345 million).

Whatever the reference period (3 years, 8 years, pre-Covid (2017-2019)), the widening of the deficit recorded in 2022 is always much more marked for tomato pastes (between +37% and +69%) than for canned tomatoes (between 27% and 47%), and almost negligible for sauces (between 8% and 1%).

It is estimated that the French market for tomato products (domestic production and imports) currently represents between 1.4 and 1.5 million tonnes of fresh tomato equivalent. With only around 11% of needs covered, the country is a long way from food independence in this sector. Moreover, the deteriorating pattern of the trade balance observed over the last twenty years has continued unabated. Calling on imports is an constant feature of the French market, and the current trend towards a widening deficit is increasingly benefiting neighboring industries in Italy, Spain, Portugal, Tunisia and elsewhere.

On average over the last five years, the main suppliers to the French market have been Italy (59% of French purchases of paste, 64% of canned tomatoes and 32% of sauces), Spain (26% of paste, 26% of canned tomatoes and 46% of sauces) and, to a lesser extent, Portugal, Tunisia, Turkey, Morocco and Greece. (See additional information at the end of this article.)

Some complementary data

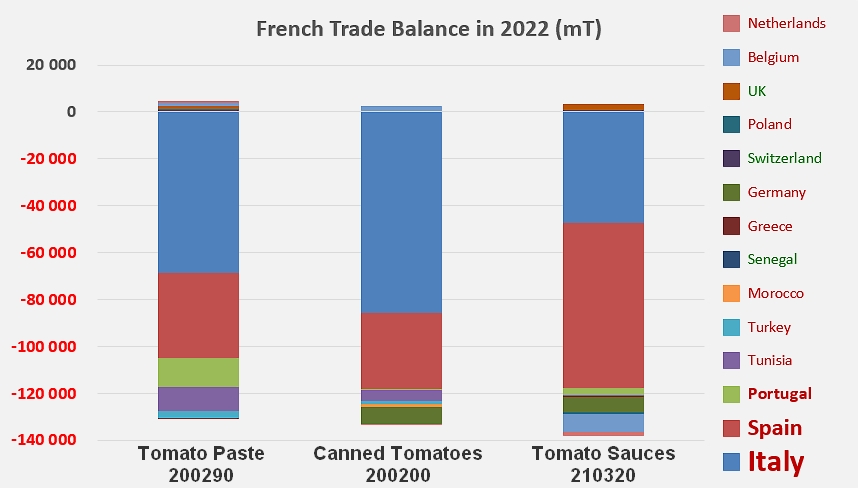

Details of trade balance by product type

In 2022, the French trade balance showed a deficit of 127,000 tonnes for the paste category, mostly from Italy and Spain; at the same time, France maintains a few virtually confidential export flows to Germany, Switzerland, Poland and other countries.

Quantities are approximately the same (-130,000 mT) for the canned tomatoes category, and the supplier countries are the same. Here also, France exports a few almost confidential quantities to Luxembourg, Ireland, the UK, etc.

The French trade balance for sauces shows similar quantities (-133,000 mT in 2022), most of which come from Spain and Italy. Minimal quantities are exported towards Morocco, Switzerland and New Caledonia.

Source: Trade Data Monitor