Results for the twelve-month period May 2022 – April 2023 show a slight decline in quantity, but a sharp rise in value.

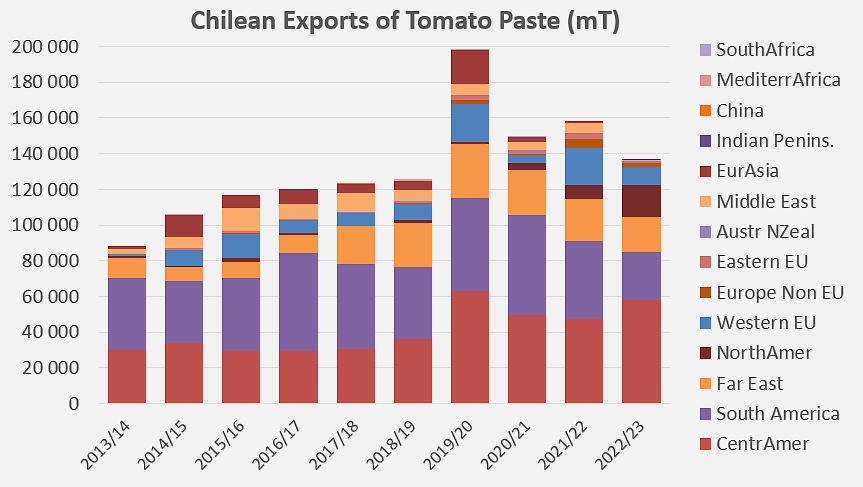

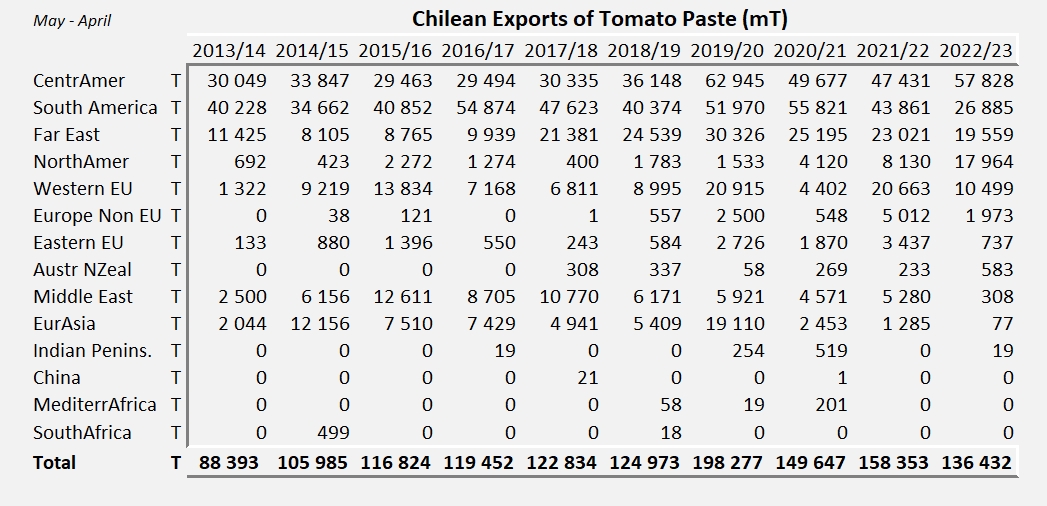

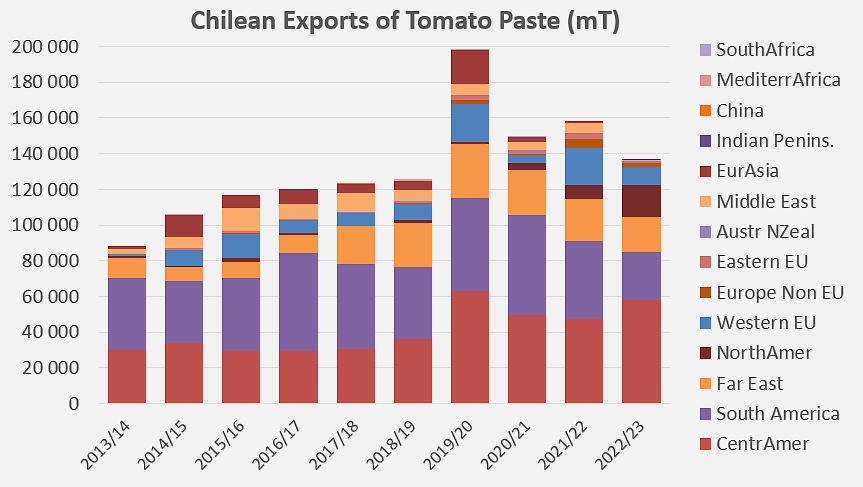

After the sharp increase driven by the explosion in global demand in 2020, Chile's annual exports of tomato pastes, while remaining at a high level, are gradually approaching the level they were recording before the Covid health crisis. With just over 136,000 tonnes exported over the twelve months between May 2022 and April 2023, foreign sales in this category – the only one in which the Chilean industry generates a surplus – are now 11% higher than over the 2017-2019 period. Results for the last period also showed a decline of around 14% compared with the same period of the previous year (May 2021 – April 2022).

The main players in these variations are naturally the countries belonging to the regions that are the largest outlets for Chilean products, in particular Central America, Latin America and, to a lesser extent, the Far East and North America.

Since the outbreak of the pandemic, foreign sales of Chilean pastes have risen spectacularly to Venezuela, Colombia, Mexico and Guatemala, while sales to Ecuador, Panama and Cuba have notably slowed (see additional information at the end of this article).

Notable declines also affected exports to Argentina and Brazil, two nations that are seeking food independence, and these decreases were not offset by increases in exports to Uruguay, Peru and Paraguay. In fact, by reducing volumes imported from Chile by 44% over ten years, South America has given up its position as the leading buyer for Chilean pastes to Central American countries, which at the same time have increased their purchases of Chilean products by over 80%.

In the Far East, foreign sales recorded a significant negative annual variation, mainly due to a slowdown in Japanese, Thai and Malaysian purchases, though overall volumes are still 5% higher than in the pre-Covid period.

As for the USA and Canada, they have sharply increased their purchases of Chilean pastes, not only over the twelve months from May 2022 to April 2023, but also compared with the pre-pandemic period.

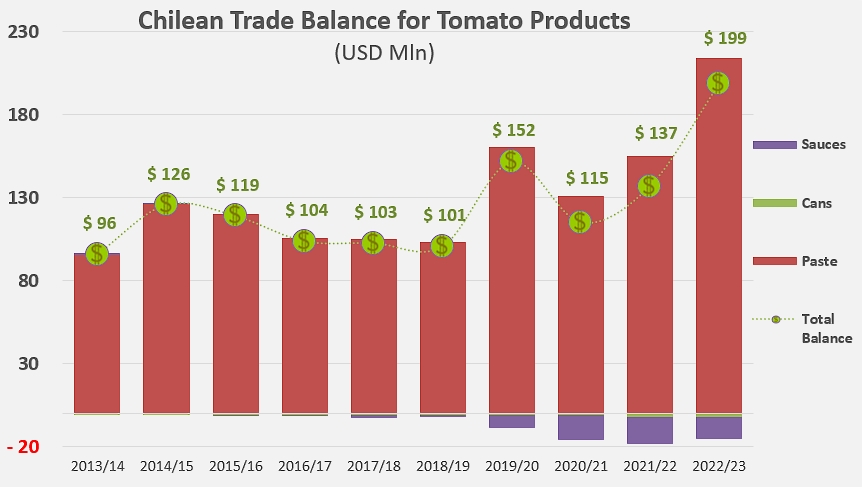

The customs value of the pastes exported over the period under review amounted to around USD 214 million, up 38% on the previous year and 105% on the average performance for the pre-Covid period.

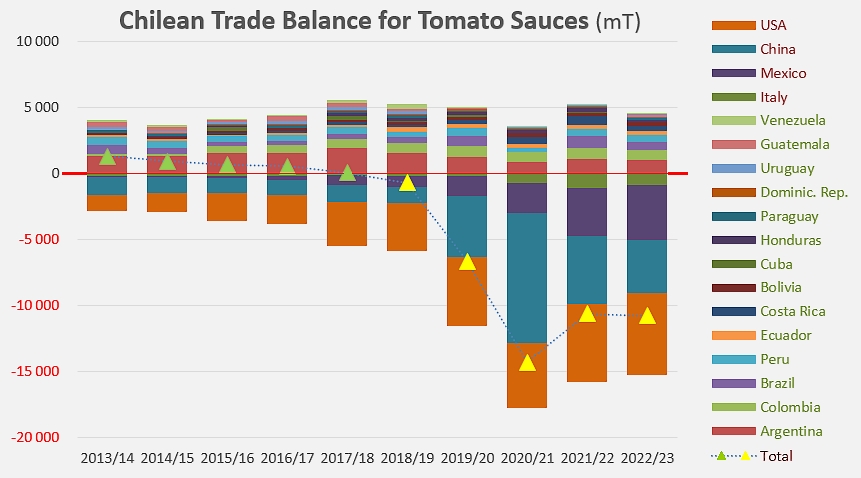

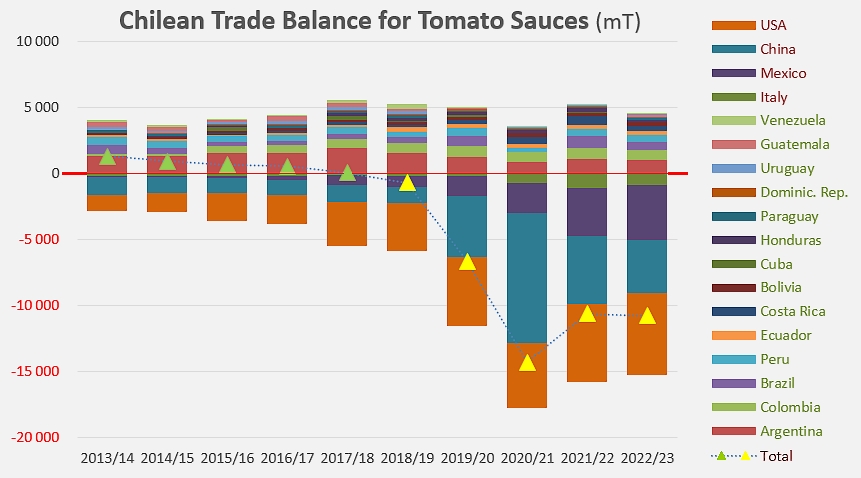

In contrast to this impressive result, the Chilean market is extremely dependent on canned tomatoes and sauces: most of the canned tomatoes imported into Chile (around 1,600 mT on average over the last two periods under review) come from Italy (between two-thirds and three-quarters of the total), Spain (10-15%) and Portugal (less than 13%). In this category, quantities are steadily increasing, but remain marginal, with annual Chilean expenditure not exceeding USD 2 million over the last two years.

Annual expenditure on sauces is considerably higher, amounting to almost USD 16 million over the period 2020-2022, before declining significantly last year. Virtually non-existent before the outbreak of the pandemic, demand grew strongly to the point of requiring the import of over 14,000 mT of products in 2020/2021, and since then seems to have stabilized at around 10,000 or 11,000 mT. The Chilean sauces market is mainly supplied by American (US), Chinese, Mexican and, to a lesser extent, Italian suppliers.

Chile maintains small export flows to Argentina, Colombia, Brazil, Peru and other countries.

In short, the combination of rising worldwide demand and the inflationary mechanisms created by the global industry's difficulties in meeting this demand have contributed to a spectacular increase in Chile's trade surplus for tomato products. The recent emergence of a deficit in the sauces sector has not fundamentally altered the pattern of foreign sales of paste. Last year (May 2022 – April 2023), the Chilean trade balance registered a surplus close to USD 200 million, up 45% on the previous period and 94% on the pre-pandemic period.

Some complementary data

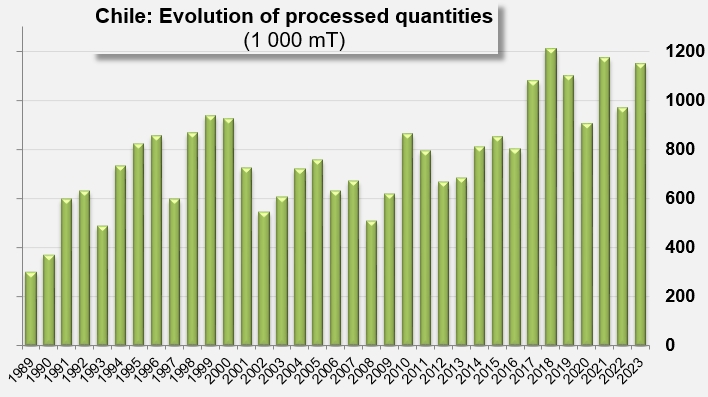

Evolution of the quantities processed by the Chilean industry since 1989.

Quantities of pastes exported by Chile, by region, since 2013/2014. Detailed tables by country are available on request from TomatoNews.

Source: Trade Data Monitor